How to Find Net Income

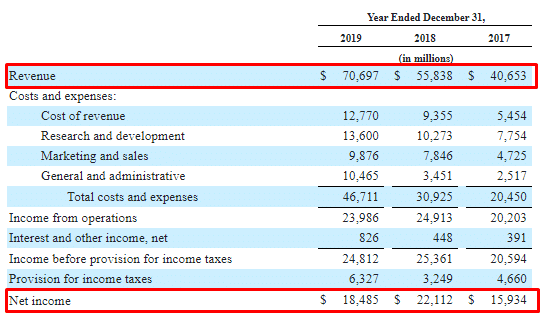

On the other hand net income is a specific number you can find on the bottom line of an income statement or by using the net income equation. Net income is sometimes called profit If your self-employment income is higher than your business expenses you report this net income.

What Is Net Income Definition Formula And How To Calculate Stock Analysis

X is working on the refinancing Refinancing Refinancing is defined as taking a new debt obligation in exchange for an ongoing debt obligation.

. You will need to provide social security numbers and income information for your entire household over the past 30 days so please have that information and documentation at hand. Net income or net profit is the figure that gives the most complete overview of a companys profitability. Medicares Limited Income NET Program effective January 1 2010 provides temporary Part D prescription drug coverage for low income Medicare beneficiaries not already in a Medicare drug plan including.

A typical banks assets consist of all. Understanding net income can take some time especially when business owners are responsible for various financial statements. The formula for net income is simply total revenue minus total expenses.

Net Operating Income Illustration. Net interest income is the difference between the revenue that is generated from a banks assets and the expenses associated with paying out its liabilities. NOI is not affected by how you finance a propertywhether you get a mortgage or buy with all cash.

Investors stakeholders analyze net income and its trend to take the decision of investment and decision related to growth and expansion of the company. Rental expenses you can deduct. Is Net Income After Taxes.

Rental income and non-resident tax Information for non-residents with rental income electing to file a tax return under section 216 of the Income Tax Act and the section 216 late-filing policy. Low-Income Subsidy LIS. If your business expenses are higher than your income you report a net loss.

X in California that cooks the best pizza in their area. Effective for tax years beginning after Dec. Find out if you can apply for this rebate.

Lets take the example of a pizza outlet owned by Mr. Its value indicates how much of an assets worth has. For example if you are working in a job in which youre paid an hourly wage your gross income is the hourly rate youre paid multiplied by the number of hours youve worked during a pay period.

Gross income includes all of your income before any deductions are taken. For example company A has a sales revenue of 1 million and high expenses so it has a net income of. 20 2019 all private foundations subject to the Section 4940 excise tax on net investment income will calculate the tax using the.

Net income accounts for all money that flows in and out of a company and is. Operating income is an accounting figure that measures the amount of profit realized from a businesss operations after deducting operating expenses such as cost of goods sold COGS wages and. In other words it is merely an act of replacing an ongoing debt obligation with a further debt.

Annual net income is the amount of money you earn in a year after certain deductions have been removed from your gross income. Yes net income is the amount of money left over after subtracting taxes cost of goods sold interest on debt and total expenses. Calculated annually it is useful for estimating the revenue potential of an investment property.

People often refer to net income as the bottom line as it is the last line item on an income statement. Net operating income NOI is a real estate term representing a propertys gross operating income minus its operating expenses. Your annual net income can also be found listed at the bottom of your paycheck.

This figure indicates whether your business is profitable. Your net income for the year is 33800 or 2817 each month. Below are answers to some of.

Created as part of the Health Care and Education Reconciliation Act to fund healthcare reform in 2010 the net investment income tax NIIT is a 38 surtax that typically applies only to high. 20 2019 Section 4940a was amended to provide a single tax rate of 139 on net investment income and Section 4940e was repealed. Your net income from self-employment is what you report on Schedule C of your federal tax return.

You can determine your annual net income after subtracting certain expenses from your gross income. The cost of doing business includes all the taxes the interest the company should pay the depreciation of assets Depreciation Of Assets Depreciation is a systematic allocation method used to account for the costs of any physical or tangible asset throughout its useful life. The cash you made last weekend selling old records or baseball cards at a garage sale.

Select 202223 in Tax Year and the calculator will show you what impact this has on your monthly take home pay and how much tax youll pay over the year. Net income tells about the profit or losses of a company also help to find profitability and grow of the company. Please answer all questions accurately and completely.

Net Income Revenue Cost of doing business. Learn about self-employment. Net income total revenue 50000 total expenses 16200 Net income 33800.

There are a lot of ways you can earn income. For tax years beginning after Dec. LIHEAP-DVP is the only program with an online application at this time.

The paycheck you get every two weeks from your job or the profits from the business you own and operateThe dividends or compound interest growth you earn from the mutual funds you invested in. The threshold at which employees start to pay national insurance changed on 1 July. Full Benefit Dual Eligible and SSI-Only beneficiaries on a retroactive basis up to 36 months in the past.

Net Income The Profit Of A Business After Deducting Expenses

How To Find Net Income Calculations For Business

How To Calculate Net Income Formula And Examples Bench Accounting

Comments

Post a Comment